ETH Price Prediction: Bullish Signals and Institutional Inflows Point to $6,000+

#ETH

- Ethereum's price is above key technical indicators, signaling bullish momentum.

- Institutional inflows and whale activity highlight strong market confidence.

- Scalability upgrades and positive sentiment suggest long-term growth potential.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

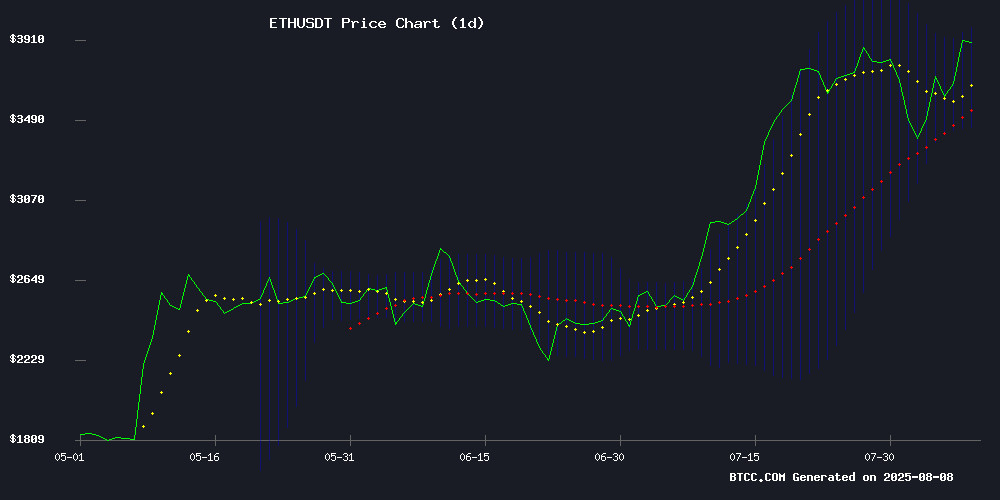

According to BTCC financial analyst Emma, ethereum (ETH) is currently trading at $3,890.25, above its 20-day moving average (MA) of $3,711.78, indicating a bullish trend. The MACD shows a positive divergence with the histogram at 126.7022, suggesting upward momentum. Additionally, the price is near the upper Bollinger Band at $3,973.70, which could signal continued strength if it holds above this level.

Ethereum Market Sentiment: Institutional Inflows Fuel Optimism

BTCC financial analyst Emma highlights that Ethereum is gaining traction amid record-high transactions and bullish institutional inflows. News of Caldera's partnership with EigenCloud to boost rollup scalability and mysterious whale accumulation of $123M in ETH further supports the positive sentiment. Despite some sell pressure, the overall market outlook remains optimistic, with Elliott Wave Theory predicting a rally to $6,000+.

Factors Influencing ETH’s Price

Ethereum Transactions Hit Record High Amid Bullish Institutional Inflows

Ethereum's network activity has surged past 2021 bull market levels, with daily transactions reaching unprecedented heights. The cryptocurrency rebounded 8% this week, recovering most of last week's pullback after testing the $3,941 resistance level. Market structure suggests a healthy consolidation - a $10 billion Open Interest flush and $1 billion in realized profits created ideal conditions for the next leg up.

Seasonal patterns are being rewritten in 2025. While August traditionally shows weakness (60% negative closes over past decade), ethereum is demonstrating unusual strength. July's atypical bullish performance and Q1's rally to multi-year lows at $1,440 confirm this divergence from historical trends. Institutional adoption metrics underscore the shift - corporate ETH holdings skyrocketed 127.7% in July to 2.7 million ETH, now representing nearly half of all ETF-held Ethereum.

The market appears to be pricing in this fundamental improvement. Ethereum's 50% rally positions it as a top-performing large-cap asset, with technicals suggesting potential for price discovery mode. As leverage resets and weak hands exit, the stage is set for a potential breakout despite traditionally unfavorable seasonal factors.

SDNY U.S. Attorney Jay Clayton Comments on Tornado Cash Developer Conviction

Former SEC Chair and acting U.S. Attorney for the Southern District of New York, Jay Clayton, emphasized the need for accountability in the crypto space following the conviction of Tornado Cash developer Roman Storm. The verdict underscores the tension between innovation and regulation in digital assets.

"Roman Storm and Tornado Cash provided a service for North Korean hackers and other criminals to MOVE and hide more than $1 billion of dirty money," Clayton stated. While acknowledging the potential of stablecoins and blockchain technology, he warned that technological promise cannot shield criminal activity.

The case sets a precedent for how authorities may approach privacy tools in cryptocurrency. Storm's sentencing date remains undetermined as the industry watches for Ripple effects across decentralized finance protocols.

Ethereum Nears $4,000 Amid Altcoin Rally and Bullish Technical Signals

Ethereum (ETH) is approaching the $4,000 threshold, fueled by a combination of surging transaction volume, institutional interest, and bullish chart patterns. The asset reached $3,718 on August 7, supported by robust on-chain activity, including 1.87 million daily transactions—the second-highest in its history.

Stablecoins like USDC and Tether, alongside DeFi platforms such as Uniswap, are driving this momentum. Regulatory clarity from the U.S. GENIUS Act has further bolstered confidence, with Ethereum processing over $50 billion in stablecoin transactions last week alone.

Technical analysts highlight a bullish pennant formation and a recent golden cross—a historically strong indicator—suggesting further upside. The 20-day and 50-day moving averages crossing above the 200-day moving average echoes a pattern last seen before Ethereum's 2020–2021 rally.

Caldera Partners with EigenCloud to Integrate EigenDA V2, Boosting Rollup Scalability

Constellation Labs, operating as Caldera, has unveiled a strategic collaboration with EigenCloud to integrate EigenDA V2 into its rollup infrastructure. This integration promises a groundbreaking data throughput of 100 MB/s, addressing a critical bottleneck in blockchain scalability.

The partnership tackles the persistent challenge of data availability for rollups, which traditionally rely on Ethereum's L1 for transaction posting—a costly and limiting approach. By leveraging EigenDA V2 as a dedicated Data Availability layer, Caldera enables rollups to achieve higher performance at reduced costs, without sacrificing security or decentralization.

"This integration unlocks unprecedented scale for our partners," said Matthew Katz, CEO of Constellation Labs. The move comes as traditional financial institutions—including payment companies and banks—increasingly explore on-chain solutions requiring enterprise-grade throughput.

Ethereum's Rally to $6,000+ Gains Momentum as Elliott Wave Theory Predicts Key Targets

Ethereum's march toward $6,000 appears increasingly plausible as it adheres to Elliott Wave projections with striking precision. The cryptocurrency hit $3,859 on July 21 before correcting to $3,510—aligning neatly with the forecasted 76.4% retracement level at $3,250. Subsequent momentum carried ETH to $3,941 by July 28, validating the predicted W-v target zone of $3,955-4,175.

Current trading NEAR $3,675 suggests the completion of gray W-iii, iv, v waves, setting the stage for the next leg up. Sunday's $3,356 low likely marked the green W-4 conclusion, with Tuesday's $3,546 dip serving as the gray W-ii bottom. The breach of Monday's $3,737 high confirms the gray W-iii of green W-5 is now active—a development that could propel Ethereum toward the 161.8% extension target near $4,525.

Mysterious Whale Buys $123M In Ethereum: Quiet Smart Money Accumulation?

Ethereum shows renewed strength, gaining over 13% since last Sunday's low near $3,350. Bulls have regained control of short-term momentum, pushing the price higher amid rising volatility. Analysts are closely watching ETH as it attempts to reclaim key resistance levels.

Institutional interest in Ethereum continues to grow, with on-chain activity climbing across DeFi, NFTs, and Layer-2 ecosystems. The network's role in real-world asset tokenization and smart contract infrastructure reinforces its long-term value proposition.

A successful consolidation above $3,700 could confirm bullish continuation, while a rejection may lead to another pullback. Either way, Ethereum's recent performance and fundamentals suggest returning investor confidence—potentially setting the stage for sustained upward movement.

According to analyst Ted Pillows, a mysterious whale or institution has accumulated $123 million worth of ETH, signaling long-term confidence in the asset.

Ethereum’s $4,000 Breakout Nears as Accumulation and Metrics Signal Imminent Rally

Ethereum's march toward $4,000 gains credibility as on-chain metrics reveal strengthening accumulation patterns. Short-term holders—addresses holding ETH for 1-3 months—have increased their share of supply from 9.57% to 11.93% in under a month, per Glassnode's HODL wave data. This cohort typically fuels breakout momentum after consolidation phases.

The Spent Output Profit Ratio (SOPR) reinforces the bullish case, showing declining profit-taking activity despite ETH's price stability. This divergence mirrors late July's setup, which preceded meaningful upside. When sellers exhaust their positions and new capital enters simultaneously, the stage is set for volatile moves.

ETH Ecosystem Gains Momentum Amid Policy Support as BAY Miner Launches Cloud Mining Service

Ethereum's ecosystem is riding a wave of regulatory tailwinds as U.S. policymakers unveil initiatives like the SEC's 'Project Crypto' and WHITE House-backed digital asset support plans. ETH has emerged as a focal point in these developments, with institutional accumulation continuing despite short-term price volatility.

BAY Miner is capitalizing on this momentum with a new ETH cloud mining service designed to bypass technical barriers. The platform promises automated daily payouts without requiring hardware ownership or trading expertise. Three-step onboarding includes account creation, ETH deposit, and automatic hashrate allocation.

Mining plans cater to various risk appetites, from short-term trials to compounded long-term strategies. The service launches as Ethereum's fundamentals strengthen, with policy recognition reinforcing its position as infrastructure-grade blockchain technology.

Ethereum Price Prediction: $419M in Sell Pressure Hits ETH – Is The Bull Market Over?

Ethereum surged 5% to $3,819 in 24 hours, outpacing Bitcoin as institutional buyers fueled the rally. Despite a weekly dip, ETH remains 49% higher month-over-month, absorbing $400M in sell pressure. A breakout above key resistance could pave the way for new all-time highs.

Analyst J.A. Maartunn flagged a -$418M net taker volume imbalance—the second-largest daily sell-side pressure in ETH futures history. Such metrics typically signal dominant selling activity, yet Ethereum's price resilience suggests underlying demand may outweigh short-term profit-taking.

Path to $1 Million in Ethereum: A Decade-Long Blueprint

Ethereum's potential to transform a disciplined investment into seven figures hinges on aggressive price appreciation and market adoption. At current prices near $3,600, an eightfold surge to $30,000 by 2035 WOULD require holding approximately 33.4 ETH—a $167,000 outlay at $5,000 average purchase price.

The network must dominate decentralized finance, tokenization, and AI-blockchain applications to justify such growth. Monthly investments of $1,391 present a steep commitment, particularly given Ethereum's notorious volatility and unproven long-term roadmap.

While the math appears straightforward, execution demands conviction through market cycles. As with any high-risk asset, the gap between projection and reality often widens with time.

Tornado Cash Developer Roman Storm Convicted on Money Transmission Charge

Tornado Cash developer Roman Storm has been found guilty of operating an unlicensed money-transmitting business after a contentious trial. The jury deadlocked on two other charges—conspiracy to commit money laundering and violations of economic sanctions—highlighting the legal ambiguities surrounding cryptocurrency privacy tools.

Prosecutors sought immediate detention, citing Storm's Russian ties and cryptocurrency holdings, including Ethereum linked to a co-founder's wallet. Defense attorneys successfully argued for his release pending sentencing, with the judge acknowledging unresolved legal battles ahead.

The verdict sends ripples through the crypto industry, establishing precedent for developer liability in money transmission cases while leaving larger questions about financial privacy unresolved. Ethereum (ETH) remains central to the case, with the court scrutinizing transactions through the contested mixing service.

Is ETH a good investment?

Based on current technical and fundamental analysis, Ethereum (ETH) appears to be a strong investment opportunity. Here’s a summary of key factors:

| Factor | Details |

|---|---|

| Price Trend | Above 20-day MA ($3,711.78) and near upper Bollinger Band ($3,973.70) |

| MACD | Positive divergence (126.7022) |

| Market Sentiment | Bullish institutional inflows, whale accumulation, and scalability improvements |

| Price Target | Elliott Wave Theory suggests $6,000+ |